The Share

The share capital at the end of the interim period amounted to SEK 62 million (58).

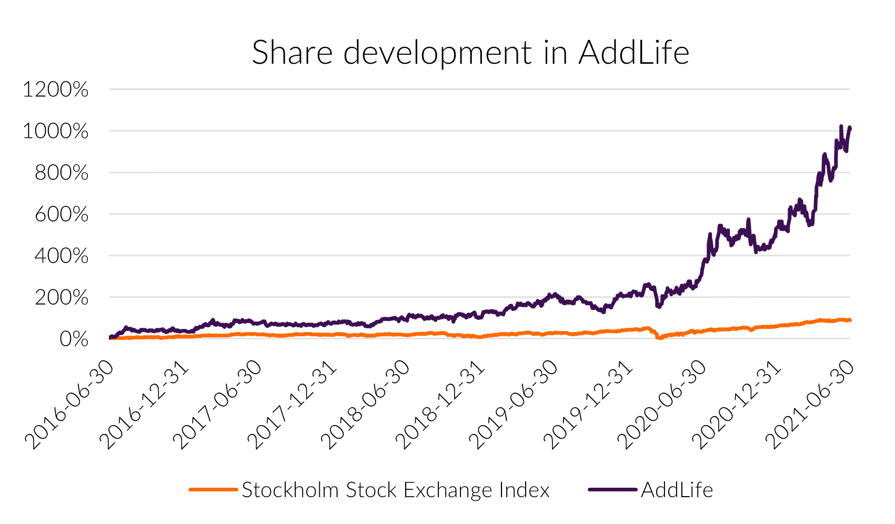

The number of repurchased own shares amounts to 507,149 Class B, corresponding to 0.4 percent of the total number of shares and 0.3 percent of the votes. The average purchase price for shares held in treasury amounts to SEK 52.12 per share. The average number of treasury shares held during the interim period was 1,294,850 (2,332,428). The share price at 30 June 2021 was SEK 263.00 and the most recent price paid for the AddLife share on 14 July 2021 was SEK 300.00.

During the quarter, two new issues of class B shares were carried out, which have been used to pay for Healthcare 21 and Vision Ophthalmology Group, in accordance with the mandate given to the Board of Directors at the Annual General Meeting in May 2020. After the two new issues, the share capital amounts to SEK 62,358,949.47. The total number of shares amounts to 122,450,250, with the number of class A shares unchanged at 4,615,136, while the number of class B shares increased from 109,883,156 to 117,835,114. Shares held in treasury have decreased from 2,007,149 to 507,149 class B shares after 1,500,000 class B shares were used as part of the payment for the shares in Vision Ophthalmology Group.

|

|

AddLife has four outstanding call option programmes totalling 2,824,000 Class B shares. Issued call options for treasury shares have resulted in a calculated dilution effect based on average share price for the interim period of approximately 0.7 percent (0.3). 880 options from the 2017/2021 program have been exercised during the interim period, corresponding to 3,696 B-shares. The remaining 55,323 options outstanding at the beginning of the interim period were repurchased at a price corresponding to market value.

| Outstanding programmes | Number of warrants | Corresponding number of shares | Percentage of total number of shares | Exercise price | Exercise period | |

|---|---|---|---|---|---|---|

| 2021/2025 | 250,000 | 250,000 | 0.2% | 259.0 | 10 Jun 2024 - 28 Feb 2025 | |

| 2020/2024 | 250,000 | 1,000,000 | 0.9% | 98.40 | 19 Jun 2023 - 28 Feb 2024 | |

| 2019/2023 | 215,000 | 860,000 | 0.8% | 76.60 | 20 Jun 2022 – 28 Feb 2023 | |

| 2018/2022 | 170,000 | 714,000 | 0.6% | 56.00 | 16 Jun 2021 – 28 Feb 2022 | |

| Total | 885,000 | 2,824,000 | ||||

On 30 June 2021, the number of shareholders amounted to 11,625, where of 57 percent are Swedish owners with respect to capital share. The 10 biggest shareholders controlled 55 percent of number of capital and 65 percent of votes.

| Share in % | ||||

|---|---|---|---|---|

| Shareholders 2021-03-31 | Class A-shares | Class B-shares | of capital | of votes |

| Roosgruppen AB | 2,160,604 | 3,924,727 | 4.97 | 15.57 |

| Tom Hedelius | 2,066,572 | 23,140 | 1.71 | 12.62 |

| SEB Fonder | 0 | 11,733,975 | 9.59 | 7.16 |

| State Street Bank & Trust Company | 0 | 10,705,086 | 8.74 | 6.53 |

| Verdipapirfond Odin | 0 | 9,830,008 | 8.03 | 5.99 |

| Swedbank Fonder | 0 | 8,798,944 | 7.19 | 5.37 |

| NTC Fidelity Funds Northern Trust | 0 | 6,409,650 | 5.23 | 3.91 |

| Handelsbanken fonder | 0 | 5,626,254 | 4.59 | 3.43 |

| CBNY-Fidelity over | 0 | 3,640,072 | 2.97 | 2.22 |

| Sandrew AB | 0 | 2,800,000 | 2.29 | 1.71 |

| Total the 10 biggest shareholders | 4,227,176 | 63,491,856 | 55.31 | 64.51 |

| Other shareholders | 387,960 | 53,836,109 | 44.28 | 35.18 |

| Total outstanding shares | 4,615,136 | 117,327,965 | 99.59 | 99.69 |

| Repurchased own shares Class B | - | 507,149 | 0.41 | 0.31 |

| Total registered shares | 4,615,136 | 117,835,114 | 100.00 | 100.00 |

| Source: Euroclear | ||||