NET SALES

EBITA

P/WC

AddLife 2022

In recent years, AddLife's acquisitions have proven the companys as a stable European player with operations in multiple niches. 2022 has been a year of change where our companies have had to demonstrate their ability to take action and continuously adapt to changing market conditions.

A leading player in Life Science

AddLife is a listed Swedish Medtech company active on the European market. AddLife owns and acquires companies in niche segments with offerings aimed primarily at the healthcare sector, from research to medical care. The subsidiaries are divided into two business areas. Labtech offers products, solutions and a wide range of diagnostic services, biomedical research and laboratory analysis. Medtech offers products, solutions and services in medical technology and home care.

Acquisitions 2022

Growth in AddLife is partially achieved through acquisitions, which is an important part of AddLife's strategy. During the year, five acquisitions have been completed with an annual net sales of approximately SEK 850m.

AddLife from a sustainability perspective

Sustainability is a central part of AddLife's vision to improve people's life by being a leading, value-creating player in Life Sciences. We embrace responsible business practices, where sustainability is an integral part of our business value. We accept our responsibility for sustainability throughout the supply chain as employer, producer and distributor, as well as in our role as a market participant.

Shareholder value

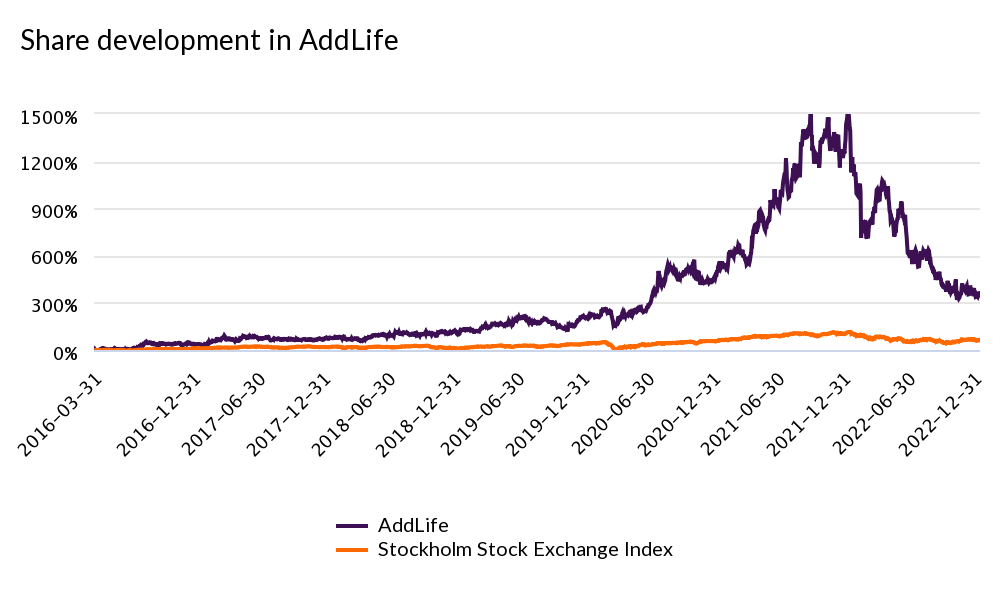

AddLife works to create both good results and a strong shareholder value. We do this, among other things, through independent subsidiaries, active ownership and acquisitions. AddLife's financial targets contribute to a strong cash flow that enable self-financed, long-term and profitable growth.

NUMBER OF SHAREHOLDERS

SHARE DEVELOPMENT SINCE LISTING