CORPORATE GOVERNANCE

Corporate Governance Principles

AddLife is a public limited liability Company whose class B shares were listed on Nasdaq Stockholm on 16 March 2016, for which reason the Company complies with the Swedish Code of Corporate Governance (the “Code”). The Code applies to all Swedish companies whose shares are listed on a regulated market in Sweden. The Code is part of self-regulation by the Swedish business community and is based on the principle of “comply or explain”. This means that companies are not obliged to apply every rule in the Code, but are allowed the freedom to choose alternative solutions provided that the reasons for any deviation is explained. AddLife has two deviations from the code to report for the 2020 financial year. The deviations and related explanations are presented in the section on the Nomination Committee. This corporate governance report has been reviewed by the auditor. The corporate governance report is available on the Company's website under Investors, www.add.life/en/investors/corporate-governance/

As of 31 December 2020, the Company had 7,501 shareholders, the 15 largest of whom controlled 67 percent of the share capital and 74 percent of the votes. At the end of the financial year, Swedish investors accounted for 53 percent of shareholders, and foreign investors owned 47 percent of the share capital. The proportion of legal entities was 84 percent, while natural persons accounted for 16 percent of the share capital. Roosgruppen AB (Håkan Roos through companies) and Tom Hedelius are the only shareholders with a direct or indirect shareholding in the Company representing at least one tenth of the voting rights for all shares in the Company.

Articles of Association

According to the Articles of Association, the Company’s name is AddLife AB and it is a public Company. The Company’s most recent financial year extended from 1 January – 31 December.

The Company's principal business is “to directly or through a wholly or partially owned subsidiary engage in trading with and produce mainly medical equipment and products, and to pursue other compatible business”. The Board of Directors is based in Stockholm and shall comprise at least four and no more than six members. Notice of the Annual General Meeting shall be published in Post- och Inrikes Tidningar (official Swedish gazette) and on the Company’s website. The issuance of the Notice of the Annual General Meeting shall be advertised in the Swedish newspaper Svenska Dagbladet.

The most recently recorded Articles of Association, adopted at the Extraordinary General Meeting on 13 January 2016, are available in their entirety on the Company’s website under investors, www.add.life/en/investors/corporate-governance/articles-of-association/

Compliance with applicable rules for trading

No violations of any applicable stock exchange rules occurred in 2020 and AddLife’s operations were conducted in accordance with good practices in the stock market.

Division of responsibilities

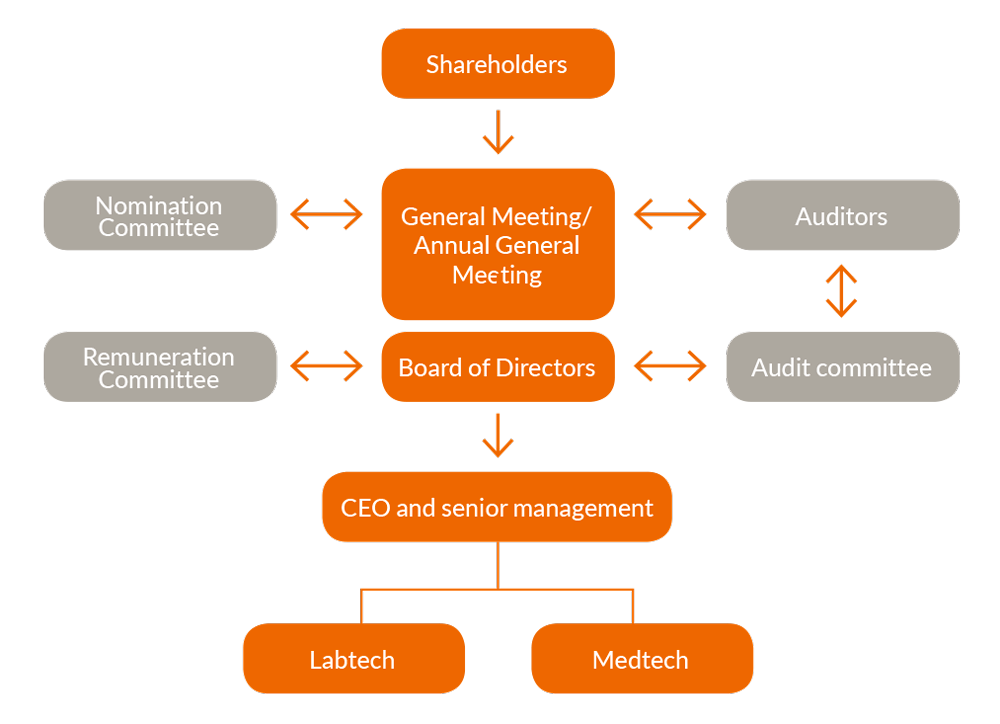

The purpose of corporate governance is to establish a clear division of roles and responsibilities between shareholders, the Board of Directors, the Board’s committees and Senior Management. Corporate governance within AddLife is based on applicable legislation, primarily the Swedish Companies Act, the listing agreement with Nasdaq Stockholm, the Swedish Code of Corporate Governance (the “Code”) and internal guidelines and regulations.

Share structure and shareholders

On 31 December 2020 share capital in AddLife AB amounted to SEK 58,309,340. There were a total of 114,498,292 shares in the Company, including 4,615,136 Class A shares and 109,883,156 Class B shares. The nominal value of each share was SEK 0.51. Each Class A share carries ten votes and each Class B share carries one vote. Only the Class B share is listed on Nasdaq Stockholm.