FINANCIAL TARGETS

FINANCIAL TARGETS

Long-term financial targets

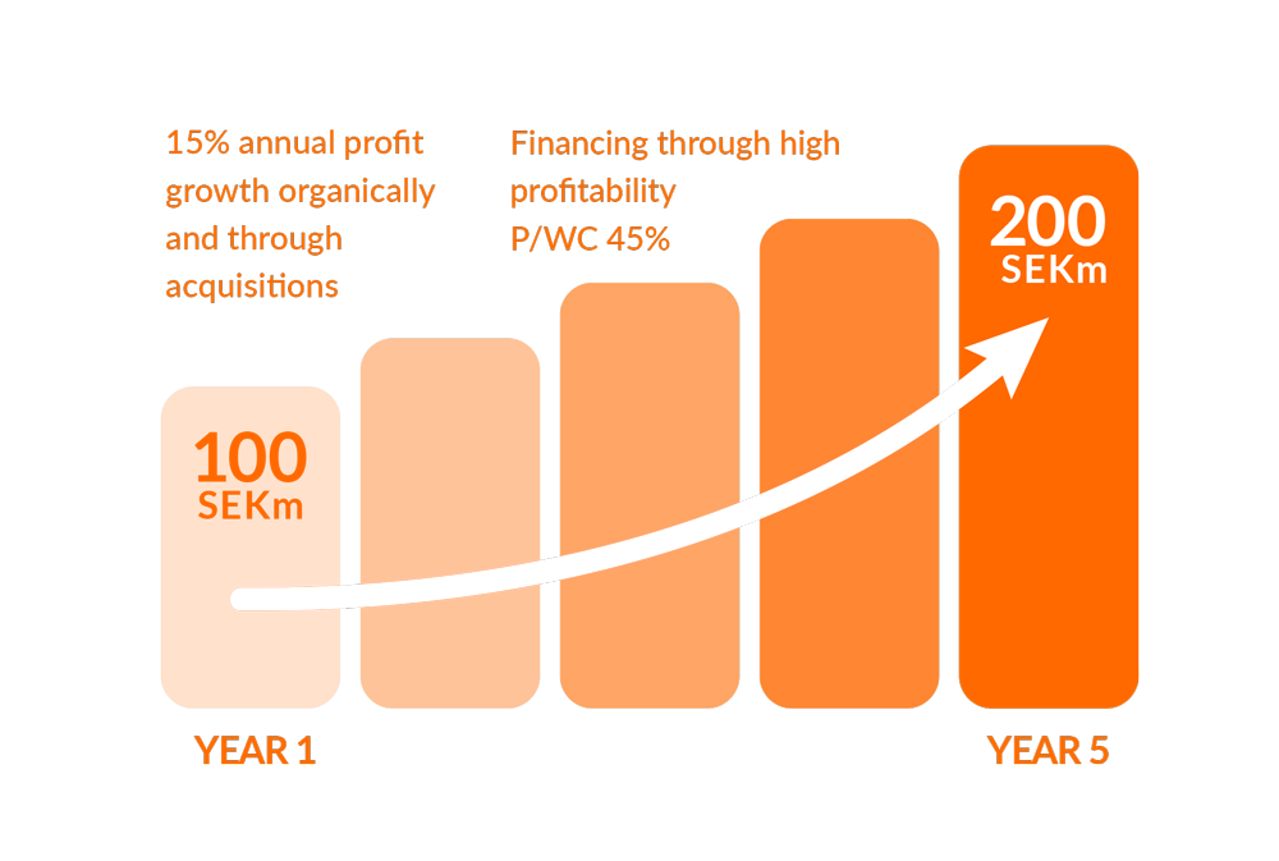

Profit Growth 15% and high profitability double the earnings

The profit target, measured in EBITA, is long term growth of 15 percent per year. A yearly growth of 15 percent will double the profit in five years. The growth will be generated both organic and through acquisitions. Through our high profitability, P/WC 45 percent, we can finance the acquisitions with our own funds.

Earnings Growth EBITA, 15 percent

The long-term goal is for EBITA growth to reach 15 percent per year. The target for EBITA growth was not achieved in 2022 due to COVID-19 related sales having a significantly greater positive impact on results in 2021 compared to 2022.

|

Dynamisk graf: Earnings growth

|

|

Profitability 45 percent

Profitability shall exceed 45 percent, measured as the ratio between operating profit (EBITA) and working capital (P/WC).

|

Dynamisk graf: P/WC

|

|

Dividend Policy 30-50 percent

AddLife's dividend policy entails a goal of a dividend corresponding to 30–50 percent of the group's profit after tax. Investment needs and other factors that the company's board considers important are taken into account.

|

Dynamisk graf: Dividend

|

|