CORPORATE GOVERNANCE

Corporate Governance Principles

Overall structure

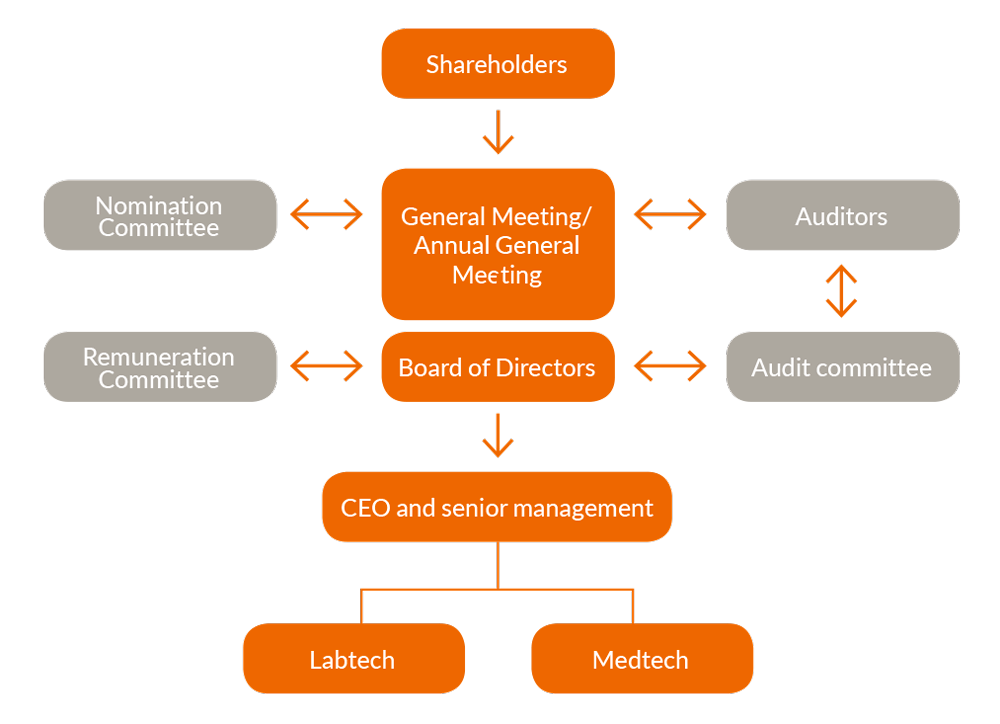

Good corporate governance is an important component in ensuring that AddLife AB is managed in a sustainable and responsible manner in accordance with applicable laws and regulations. The corporate governance within AddLife AB defines decision-making systems, clarifies roles and responsibilities between owners, board of directors, board committees, and executive management, and ensures transparency towards the group's stakeholders.

The AddLife group consists of approximately 85 companies in about 30 countries. The parent company in the group is the Swedish public limited company AddLife AB, whose B-shares are listed on Nasdaq Stockholm. In addition to what follows from the Swedish Companies Act, applicable Swedish and foreign regulations and directives, as well as laws and regulations, good practice on the stock market, and Nasdaq's rules for issuers, the group's corporate governance is based on the Swedish Code of Corporate Governance ("the Code"). This corporate governance report has been reviewed by the company's auditor. The corporate governance report is available on the company's website under Investor Relations, www.add.life/investor-relations/corporate-governance.

Good compliance with the Code, stock exchange rules, and good practice

AddLife follows the Code's principle of "comply or explain", and for the financial year 2022, AddLife has in all material respects complied with the Code, except for two deviations from the Code's rule 2.4. The deviations and their justifications are found in the section on the Nomination Committee. No violations of applicable stock exchange rules have occurred, nor have any violations of good practice on the stock market been reported by Nasdaq Stockholm's disciplinary committee or the Swedish Securities Council during 2022.

Articles of Association

According to the articles of association, the company's name is AddLife AB and it is a public company. The company's latest fiscal year covers the period from January 1 to December 31. The company's business is "to conduct trade in and manufacture mainly medical equipment and products, either on its own or through wholly or partly owned subsidiaries, and to engage in other related activities". The board of directors is based in Stockholm and shall consist of at least four and no more than six members.

The company's articles of association do not limit the number of votes that each shareholder can cast at a general meeting. The company's articles of association do not contain specific provisions regarding the appointment and dismissal of board members, or the amendment of the articles of association. The latest registered articles of association were adopted at the ordinary general meeting on May 5, 2021, and are available in full on the company's website under Investors, www.add.life/investor/corporate-governance/articles-of-association.

Share structure and ownership

As of December 31, 2022, the company had 13,131 shareholders and the 15 largest shareholders controlled 62 percent of the share capital and 70 percent of the votes. At the end of the fiscal year, the proportion of Swedish owners was 63 percent and foreign investors owned 37 percent of the capital. The proportion of legal entities was 86 percent and individuals accounted for 14 percent of the share capital. Roosgruppen AB (Håkan Roos via the company) and Tom Hedelius are the only shareholders who have a direct or indirect stake in the company representing at least one-tenth of the total voting rights for all shares in the company.