EU Taxonomy report 2022

This is AddLife’s EU Taxonomy Report, based on EU regulations to establish a framework that facilitates sustainable investment (“EU taxonomy”). The aim of the EU taxonomy is to establish common definitions for and reporting about which economic activities are in line with the EU’s 2030 Sustainable Development Goals. The EU taxonomy describes which sectors should report, which economic activities “should be covered by the taxonomy” (within its scope) and which business operations meet the technical review criteria to be “compliant with the taxonomy requirements” in accordance with EU goals. AddLife's business operations are mainly associated with economic activities that are not currently covered by the EU Taxonomy Regulation.

Accounting principles

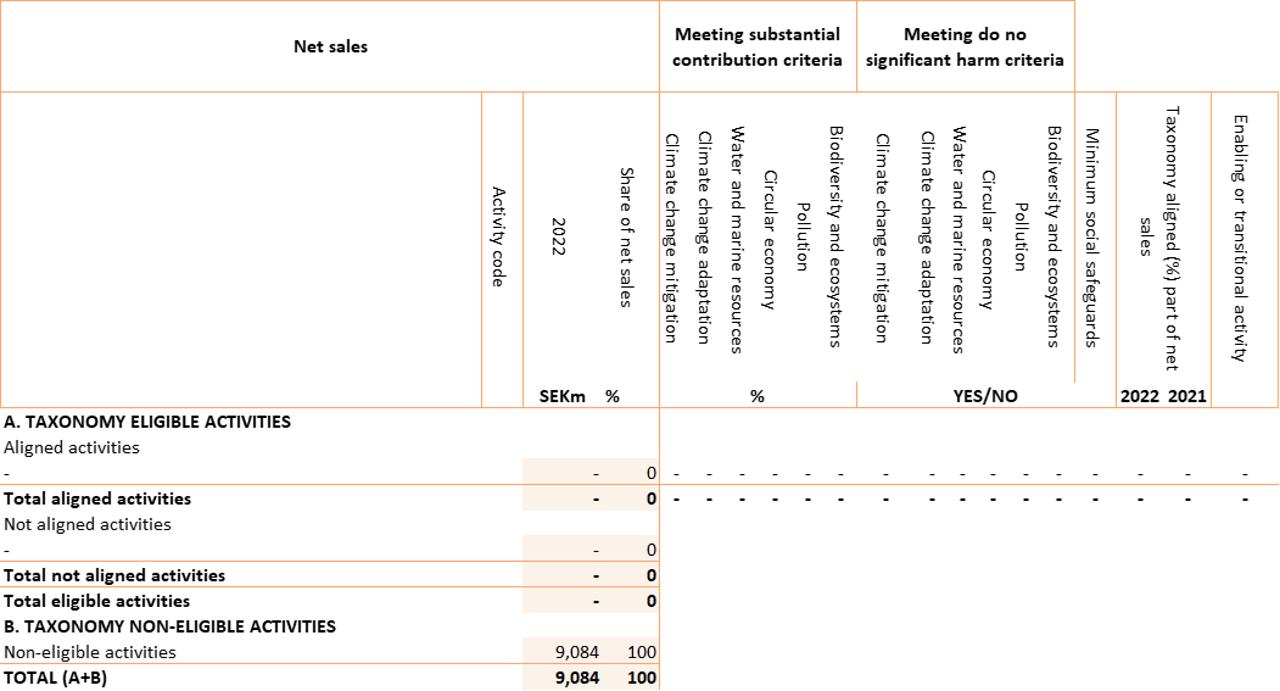

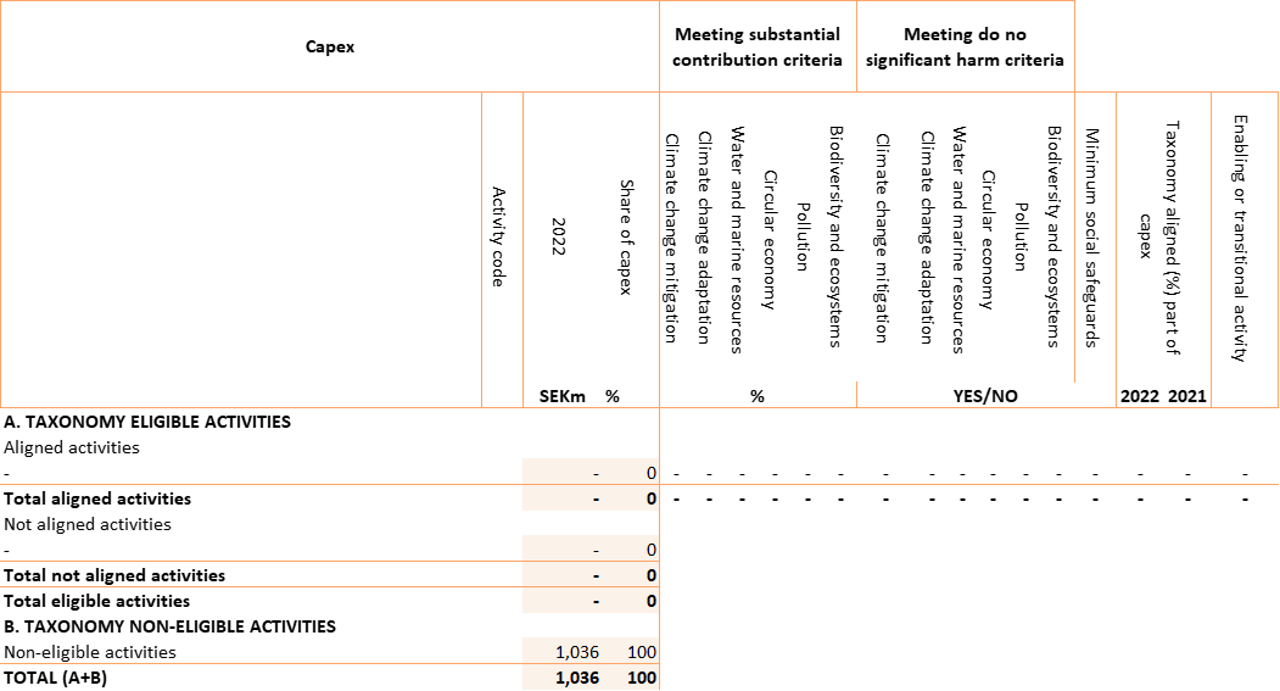

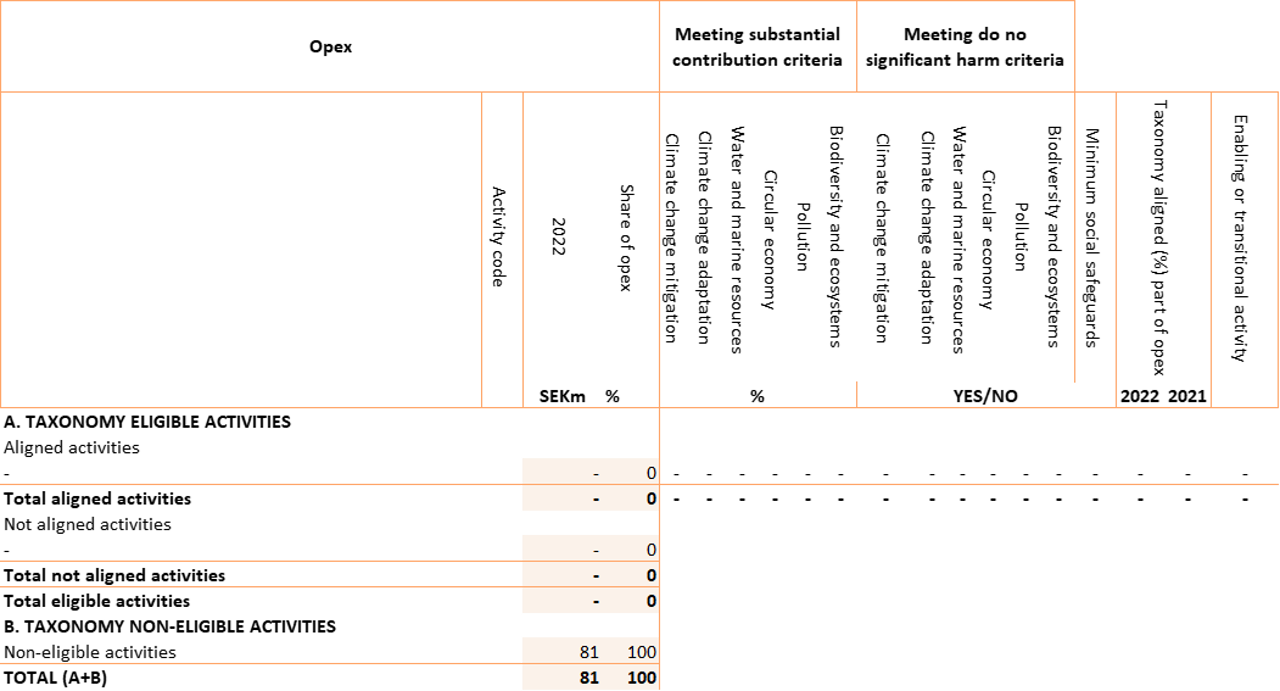

The proportion of the business operations that are environmentally sustainable according to the EU Taxonomy Regulation should be reported using three financial ratios. To calculate the three ratios, net sales, capital expenditure (capex) and operating expenditure (opex) have to be identified according to the taxonomy.

Net sales

Net sales is the part of the net sales derived from products or services

Capital expenditure

The reporting of total capital expenditure refers to additions to tangible assets during the year before depreciation, write-ups and write-downs, and excluding changes in fair value. Tangible assets arising from business combinations are also included. See Notes 15 and 16.

Operating expenditure

In the context of the EU taxonomy and the Regulation, operating expenditure is defined as direct non-capitalised expenditure relating to research and development (R&D), building renovation activities, short-term leases, maintenance and repairs, and direct costs related to the day-to-day maintenance of assets, i.e. not the total operating costs, but only costs relating to the maintenance of the assets. Only R&D, repairs and maintenance are included in this report, as all other areas are considered to be insignificant.